florida death inheritance tax

Moreover Florida does not have a state. Citizen o not a US.

Florida Inheritance Tax Beginner S Guide Alper Law

File the decedents state and federal tax return by the tax date following the year they passed away.

. For estates of decedents who died on or before December 31 2004 and that are required to file a federal estate tax return Federal Form 706 or 706-NA the personal representative must file a Florida Estate Tax Return Florida Form F-706. Inheritance tax is what the beneficiary the person who inherited the wealth must pay when they receive it. If someone dies in Florida Florida will not levy a tax on their estate.

Florida Estate and Inheritance Tax Laws. Florida also has no. Estate tax is the amount thats taken out.

Florida does not have a separate inheritance death tax. Nonetheless Florida residents may still have to pay inheritance tax when they inherit property from someone else. Florida residents do not need to worry about a state estate or inheritance tax which is a tax that is levied on people who either own property in the state where they died estate tax or inherit property from a resident of a state inheritance.

No State Estate or Inheritance Tax. Fortunately there is an exemption called the Unified Credit which lessens the blow for most estates. For multiple descendants Florida law divides the probate assets along generational lines.

If an individuals death occurred prior to that time then an estate tax return would need to be filed. In Florida there are no estate or inheritance taxes. If the decedent was unmarried at the time of death and left no will but had one or more surviving descendants those descendants receive the entire estate.

We refer to it as the estate tax which may also be called a. This law came into effect on Jan 1 2005. There are no inheritance taxes or estate taxes under Florida law.

The inheritance tax in Florida is the legal rate at which the state of Florida taxes the estate of a deceased person. Inheritance Tax IHT is paid when a persons estate is worth more than 325000 when they die - exemptions passing on property. The Florida Constitution safeguards its residents and all heirs from Florida state taxes levied on the deceaseds estate.

However it is important to be aware that while there is no inheritance or estate tax the executor will still have to do the following. Are there inheritance taxes in the state of Florida. This applies to the estates of any decedents who have passed away after December 31 2004.

Inheritance Law for Unmarried Decedents. There is no inheritance tax in Florida but other states inheritance taxes may apply to you. However an estate tax that applies to citizens of all states is levied by the federal government.

Does Florida Have an Inheritance Tax or Estate Tax. The federal estate tax only applies if the value of the estate exceeds 114 million 2019 and the tax thats incurred is paid out of the estatetrust rather than by the beneficiaries. Youll need to check the laws of the state where the person you are inheriting from lived.

However any inheritance could be eligible for federal estate taxes. As of 2021 states that impose inheritance tax include Minnesota Pennsylvania New Jersey. Although beneficiaries are responsible for paying the inheritance tax while estates pay the estate tax many estates step in to take this financial burden off their.

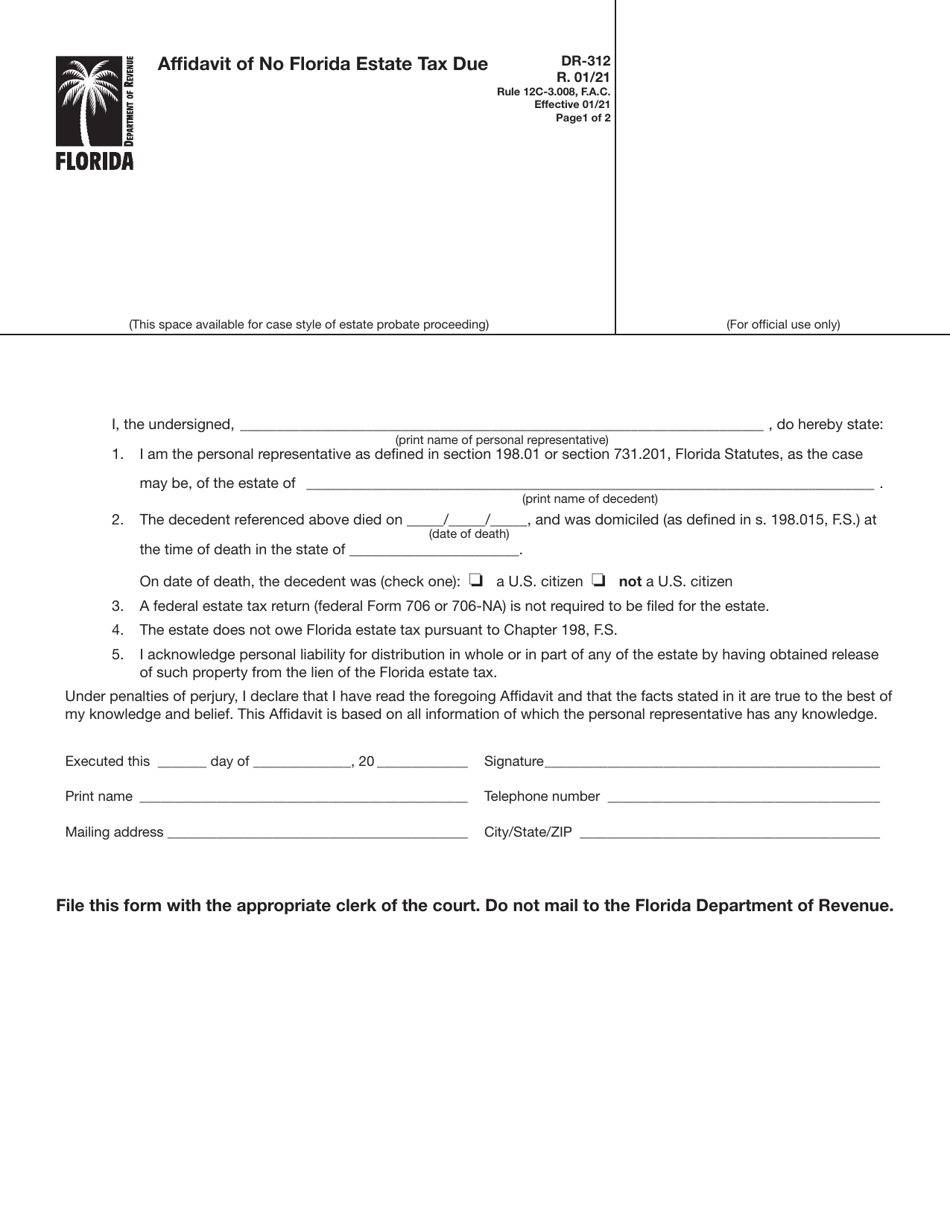

An inheritance is not necessarily considered income to the recipient. On date of death the decedent was check one. Florida does not have an estate or death tax which may raise the amount received by beneficiaries substantially compared to other states.

If all the decedents children survive the estate is. An inheritance tax is a tax on assets that an individual has inherited from someone who has died. Sometimes known as death duties.

As of 2020 only six states impose an inheritance tax on its residents but Florida is not one of them. The estate does not owe Florida estate tax pursuant to Chapter 198 FS. If Florida estate tax is owed download the Filing Requirements for Florida Estate Tax document for more information.

There are no inheritance taxes or estate taxes under Florida law. Some of these estates include IRAs cash. Assets earned from inheritance are not considered regular income so the taxable income is not impacted by them.

This applies to the estates of any decedents who have passed away after December 31 2004. Does Florida Have an Inheritance Tax or Estate Tax. Sometimes referred to as the death tax or inheritance tax what is the inheritance tax or estate tax.

Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax. Florida Inheritance Tax and Gift Tax. For Florida residents and Florida citizens the good news is that the does not have a Florida inheritance tax or an estate tax.

If the person giving them the property lived in one of the six states that do levy an inheritance tax that state would collect an estate tax. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40. However in Florida the inheritance tax rate is zero as Florida does not actually have an inheritance tax also called an estate tax or death tax.

Florida doesnt collect inheritance tax. If an individuals death occurred prior to that time then an estate tax return would need to be filed. As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax.

The bad news is that the United States federal government does have an estate tax. International tax law distinguishes between an estate tax and an inheritance taxan estate tax is assessed on the assets of the deceased while an inheritance tax is assessed on the legacies received by the. Does the State Impose an Inheritance Tax.

Florida residents and their heirs will not owe any estate taxes or inheritance taxes to the state of Florida. A federal estate tax return federal Form 706 or 706-NA is not required to be filed for the estate. I acknowledge personal liability for distribution in whole or in part of any of the estate by having obtained release of.

The federal government however imposes an estate tax that applies to residents of all states. In Pennsylvania for instance the inheritance tax may apply to you even if you live out of state as long as the deceased lived in the state. An inheritance tax is a tax paid by a person who inherits money or property of a person who has died whereas an estate tax is a levy on the estate of a person who has died.

The death tax can be any tax thats imposed on the transfer of property after someones death whether that tax is based on the total value of the decedents estate or the value of a single bequest. Does Florida have estate and inheritance taxes. The Federal government imposes an estate tax which begins at a whopping 40this would wipe out much of the inheritance.

Florida does not have an inheritance tax also called a death tax. Even though the deceaseds main residence is outside of Florida the heirs wont be required to pay state taxes.

New York S Death Tax The Case For Killing It Empire Center For Public Policy

It May Be Time To Start Worrying About The Estate Tax The New York Times

Taxes In Florida Does The State Impose An Inheritance Tax

Eight Things You Need To Know About The Death Tax Before You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Inheritance Tax Florida How To Discuss

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Inheritance Tax Beginner S Guide Alper Law

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

States With An Inheritance Tax Recently Updated For 2020

Florida Attorney For Federal Estate Taxes Karp Law Firm

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers